Update since Friday: The regional inflation statistics came out. As expected, the overall reading for May came in slightly lower than March, at 9.4% (down from 10%). Also, the trends discussed in Friday’s article continue in the most recent data – more inflation in rental prices and services, and of course gas prices, suggesting a much broader inflationary “front” than we saw even a few months ago. These are national trends as well. In the local papers, Jonathan Lansner offers excellent insight into some of the causes of the inflation, including the Russia-Ukraine war and fiscal stimulus.

Consider yourself caught up! After a 2-month or so break from my articles, your regional economic newsletter can resume its normal pace of providing economic updates every Tuesday, followed by “special topics” posts on Friday. As a summary, here is where the regional economy stands as of mid-2022:

Housing market highlights: some slowdown is expected due to higher mortgage rates caused by higher interest rates from the Fed, and it’s likely we’ll see even more rate increases through the rest of 2022 (even this week, a 50 basis points hike is expected). But housing supply growth remains strong, and buyers remain active (inventory is still low and interest rates are still low by 20-year historical standards), leading to an overall healthy outlook.

Housing market risks: The major risk comes from any abrupt Fed rate increases. If the Fed increases rates very quickly because of inflation concerns, this could jolt housing demand and cause further ripples in other parts of the economy such as construction, physical capital investment (borrowing for new machinery/equipment), or finance.

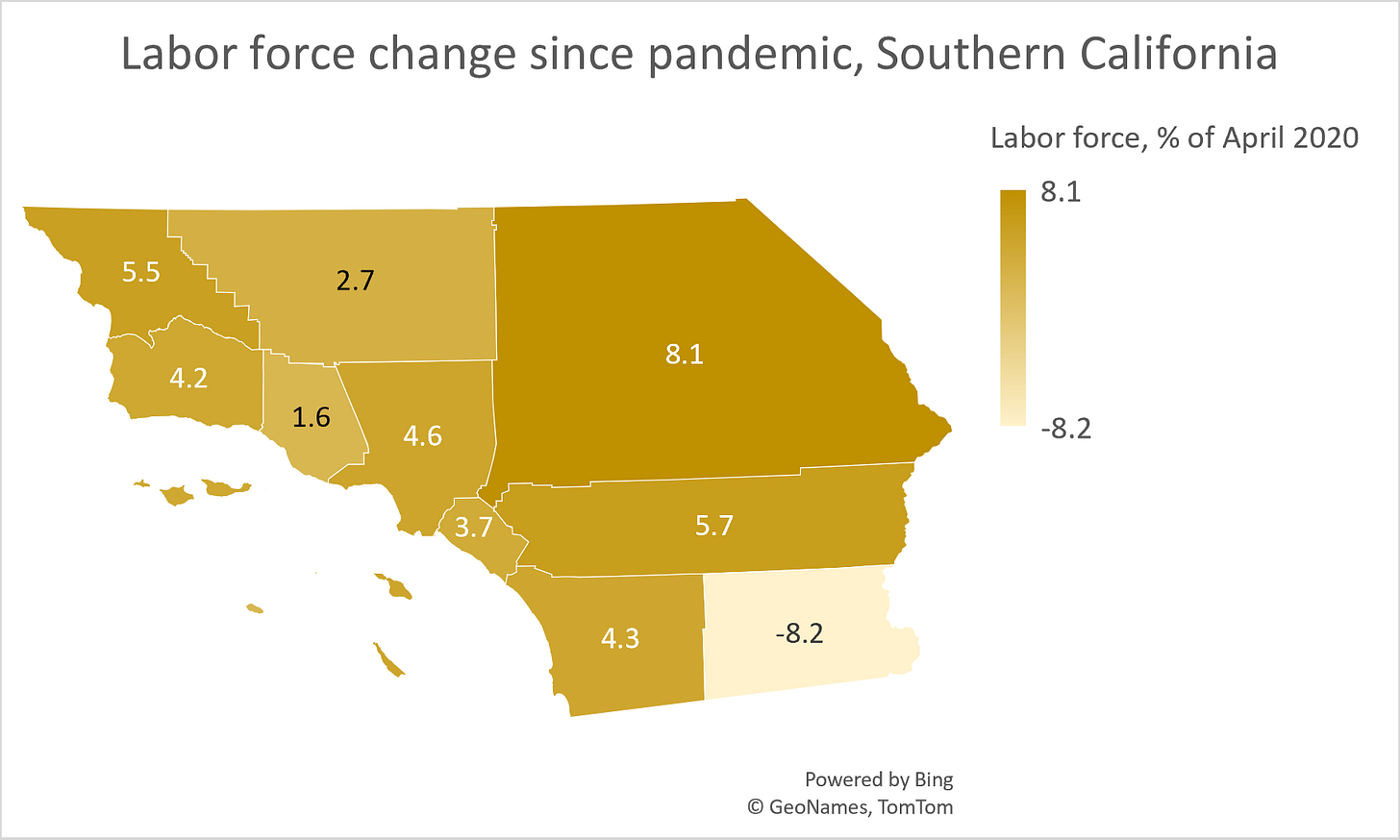

Labor market highlights: the region’s unemployment rate is back to its pre-pandemic lows of under 4%, and jobs have pretty much completely recovered from the pandemic. Broad employment growth in many industries combined with slightly lower but decent wage growth rounds out the forecast. Labor force growth has been particularly strong in San Bernardino County (see graph below).

Labor market risks: we could see anecdotes of slower consumer demand start to show up in the data, especially logistics. If employers start to pull back on their wage offers and make fewer offers in general, it could initiate a “domino effect” where other employers start pulling back, dragging us into a recession.