OK, I admit it – I am stealing this week’s special topics post idea from Jonathan Lansner’s recent (Thursday, September 22 – see here) breakdown of Southern California real estate employment statistics.

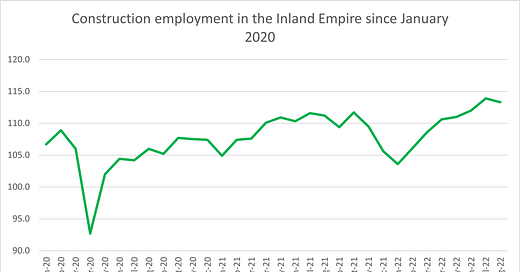

Lansner used employment statistics to track changes in the real estate market, to understand the impact of rising interest rates. It’s similar to what I did here, but much more in depth and more nuanced. He begins by noting that we have three industries to look at: finance, real estate, and construction. Construction is not a leading sector in this story. For the past year, builders have responded to higher prices by putting more projects online, boosting rather than slowing construction employment. It will take a while for falling prices to cause builders to pause or even cancel project plans, and in the meantime, construction employment will give a false signal about market health. See the chart below (numbers are in thousands of workers).

Finance or real estate firms, move more closely with current market conditions and are therefore better indicators of what’s on the horizon. Thus, as Lansner says, “it’s a split picture: Construction was 3% above February 2020 levels vs. 4% below [for] real estate and finance firms”. Let’s dive into this latter part of his observation a bit more.

First of all, the Financial Activities industry, which is composed of any finance, insurance, or real estate company, is not a very large part of the IE labor market. About 47 thousand workers, or about 2.8% of nonfarm employment and 3.3% of total private employment in the Inland Empire, are employed in this industry. (In Los Angeles, those proportions are 4.7% and 5.3% respectively.) Within Financial Activities, half of employment is in Real Estate and Rental and Leasing (“RE”), while the other half is in finance and insurance (“FI”). (Things are split more toward FI in Los Angeles.)

At any rate, back to Financial Activities. We are tracking this industry to pick up any signs of an impending downturn. Statistics show that FI employment is indeed down year-over-year by 700 jobs (24.4 thousand to 23.7 thousand), and most of the losses have occurred specifically in the depository credit intermediation subsector (commercial banks, savings banks) - 8,300 to 7,500. Major occupations in this sector include loan clerks and loan officers. See the chart below for the year-to-year employment trends in these specific subsectors. Add 7.5+16.2 to obtain the total FI employment in August 2022.

Thus, according to the numbers and more generally according to Lansner, we are seeing the first steps in the process of a real estate downturn, as lenders pull back due to higher rates, cooling down credit markets.

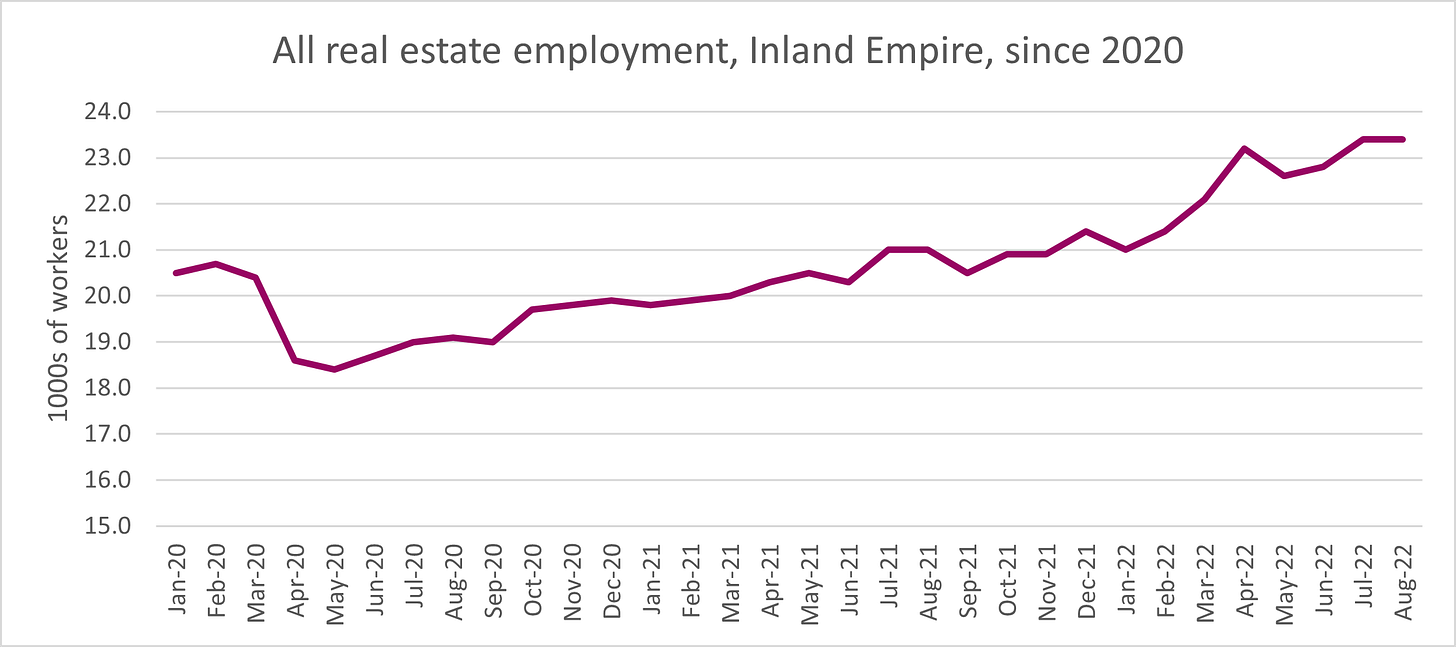

A corollary to these observations is that, like Construction, the RE sectors have yet to show signs of weakness. RE employment in the region is up 2,400 jobs year-over-year in August. See the chart below. According to Lansner, this is “simple math” – first you have a financing freeze, followed by a more general fall in employment at real estate offices and of course construction. Over the coming months, I expect these offices to shed jobs which could ripple into other parts of the economy accordingly.