QCEW data sheds light on the Q1-Q2 2021 recovery

Note: The household labor force survey for October just came out this morning! It looks like another strong report – a lower unemployment rate and higher labor force participation being just two highlights – but I’ll have more to say about that as part of your regular economic update next Tuesday the 7th.

Also - thank you so much for sharing the newsletter. The newsletter has received many more views than usual recently thanks to your help. Please urge people to subscribe as well. It’s free and helps boost visibility even more. I’m also working on a few advertising campaigns - stay tuned!

The Quarterly Census of Employment and Wages is considered the gold standard for labor market data. The release of the Q2 2021 numbers earlier this week gave us some more information on how the economy was doing in the midst of the vaccine rollout in April, May, and June. Recall that these data are truly a near census of establishments, which is why there is such a lag in their rollout.

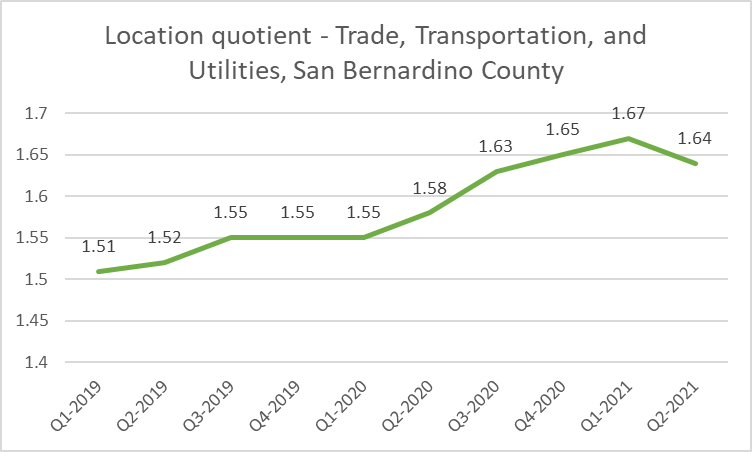

The location quotient for the logistics sector remained one of the major highlights of these data, showing a remarkable rise from Q1 of 2020 (ending in March 2020). According to the most recent statistic of 1.64, this means that if the logistics sector employs 15 out of every 100 jobs nationally, then it employs about 25 out of every 100 jobs in San Bernardino County, or a 64-67% higher prevalence rate.

Wages also were up about 5%, with the largest gains reported in Construction. Between Q1 and Q2 of 2021, average weekly wages in that sector increased from $1,222 to $1,354, or close to 11%. The importance of the vaccines is highlighted by the fact that, of the 10,000-or-so jobs added from Q1 to Q2 of 2021, close to 70% of those jobs came from the leisure and hospitality sector (i.e., restaurants, hotels, etc.).

The other exciting bit of news is to see how our performance compared to nearby areas. The Q1-Q2 wage growth statistics in San Bernardino County were higher than San Diego, Los Angeles, and even Riverside County. Employment growth was similar, but slightly higher in San Diego and Los Angeles, which benefited from more tourism traffic, especially as we moved into May and June.