Logistics and job growth in the Inland Empire

The trade, transportation, and utilities sector of the Inland Empire's economy is the region's top job provider, providing about 26.5% of all nonfarm jobs and 31.7% of total private employment today. Its most visible subsector is logistics, which is synonymous with the region.

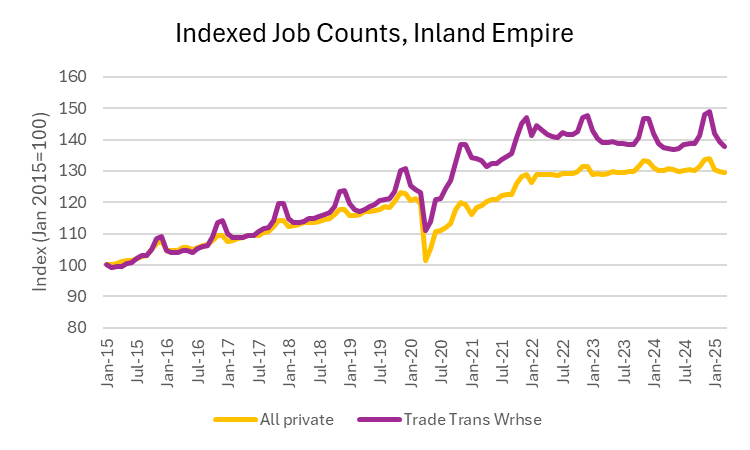

Like most sectors, logistics jobs were hit hard by the pandemic, but they quickly bounced back and were growing above their pre-pandemic averages through the rest of 2020, as well as 2021 and a good part of 2022. See the chart below.

Late-2022, job growth in logistics slowed down, and for 2023 job counts were actually *shrinking* in this sector - although they didn't erase the gains made in 2020-2022. In late 2024 logistics job growth returned to positive levels, but job growth has remained slow since 2023, consistent with private sector job growth in general. See the chart below. A few sectors are growing faster - notably local government and health services - but losses in manufacturing, construction, and leisure and hospitality have outweighed the gains.

Today, the share of private sector jobs in trade, transportation, and utilities is slightly above the pre-pandemic era on a year-over-year basis, but the trend is downward (see chart below), suggesting we are returning to the norm.

This will be an important sector to watch over the year, as it is intricately tied up with trade, consumption spending, and the regional economy overall. If the economy starts to sour on these metrics, the *upward* drive that logistics provided to jobs could quickly turn to a downward drive. As of now, there are no strong signs of this: consumer spending growth was 0.7% in March 2025, and 0.5% in February. See here.

Data for this article from the Bureau of Labor Statistics