Latest jobs numbers show the public sector employment crisis is still a big deal

Manufacturing and financial activities also continue to underperform

The region’s November employment report (from the establishment survey) dropped last Friday, December 17. The headline numbers are:

Jobs increased by 16,000 (non-seasonally adjusted) from October 2021

Average weekly hours remained essentially unchanged, at 35.8 (they were 35.8 a year ago, too)

Average hourly earnings are at $28.87, up from $26.53 (8.8%) a year ago

Overall, this was a strong report. With the latest jobs increase, we are now about 4% shy of pre-pandemic jobs levels. It would be nice if weekly hours had increased a bit more, but 35.8 is still one of the highest we’ve seen in several years. And of course, great news on the wages front, as the labor shortage continues to be a boon for the area’s workers.

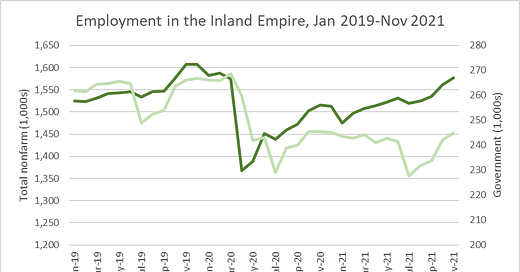

However, one sector that continues to underperform is “Government”, i.e., the public sector. This is a big deal – the public sector employs about 15% of the area’s workers and provides a lot of unionized jobs. I mentioned this underperformance a few months ago, and it continues to be a sore spot in the region’s labor market recovery today.

The public sector employment crisis is real! It is mainly driven by changes in local government, specifically employment in schools. Diving into the subsector employment numbers, my calculations show that other parts of the public sector have grown mostly in tandem with the rest of the labor market. Hopefully the increase we’ve seen over the last few months can continue, but it still needs a lot more to catch up.

A few other sectors look like this – “Financial Activities” and “Manufacturing” – although they employ a smaller fraction of the region’s workforce (2.7% and 5.9% respectively). Financial activities refer to firms in the insurance, banking, and real estate industries. The drop that we saw back in April 2020 has been accompanied by very little upward or downward movement since then. See the chart below.

Here, it’s really in banking and insurance, and less in real estate, where we saw the big drop in employment.

While it’s great that the labor market continues to recover, it’s also important that we see broad-based growth and recovery, instead of just month-to-month increases in retail and logistics.