Update since Tuesday: The national jobs report for June came in this morning: 370 thousand new jobs over the last month! This was a strong report, showing the economy has yet to show any major signs of a slowdown. This thesis is consistent with my Tuesday article on local consumption data – check it out here.

Also: thank you to the new subscribers! If you work in the IE or in Southern California more broadly, I’d appreciate it if you share this article with your colleagues at work, or share with a friend who lives out here. Let’s keep the subscription base growing – it helps improve the conversation and the writing. Please share!

While we might not be in a recession, several experts have noted a dip in the real estate market, and even local papers are talking about it. John Wake and Bill McBride are my two top analysts on this issue, and both have written recently about declining sales and falling prices across several markets. I strongly recommend everything they write – please check them out and consider subscribing to learn about how other regions and the national market are doing.

Right now, the Inland Empire is also showing signs of a slowdown – but I wouldn’t call it a downturn yet. My go-to indicators have been inventory and prices, but sales and listings are important too.

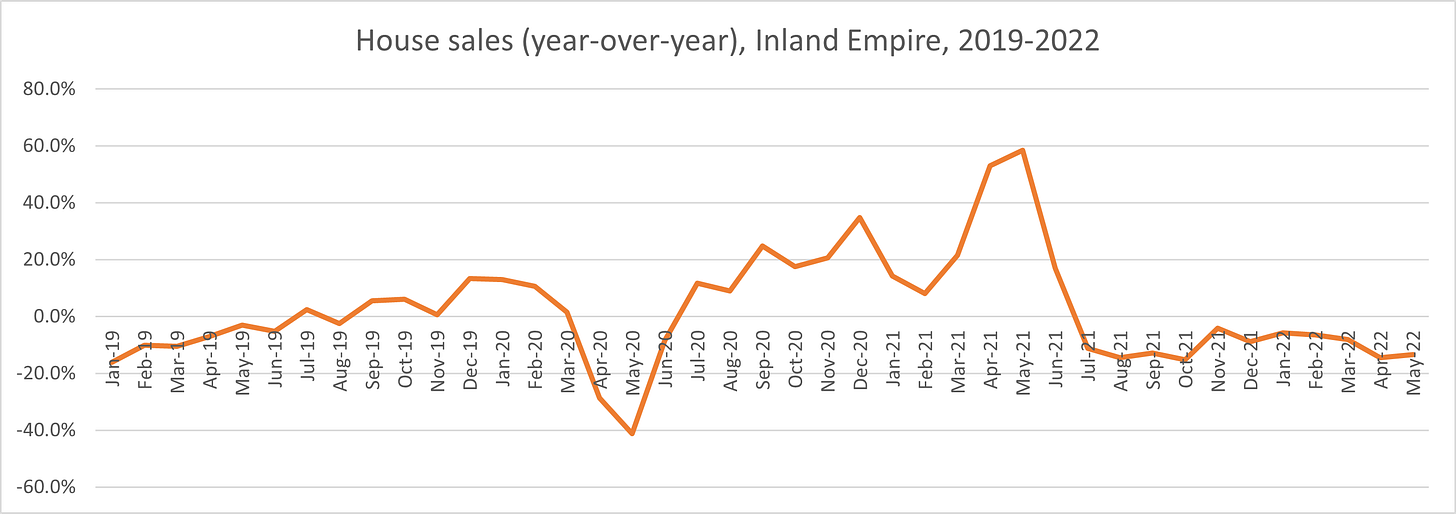

Regionally, sales are down 13.4% year-over-year in May 2022, the most recent month for which we have data. See chart above. Now, I’m sure many agents would not say that May 2021 was a normal month for sales, and so the numbers we are seeing could just reflect a more normal, less red-hot, market – a slowdown, not a downturn. For example, regional listings were up about 2.9% year-over-year (see the data here).

The problem with the downturn thesis is that supply remains low: regional inventory is still hovering at around 2 months (2.3 in May 2022, data not reported but available here), and was even under 2 months earlier this year. So even with slower sales/demand, we are still seeing upward pressure on prices. Indeed, the median price of a house in the Inland Empire rose again in May – it’s now just shy of $600,000 (up from $510,000 in May 2021). This is also why I am wary of calling this a downturn yet – slowdown seems more accurate.

It’s still too early to infer much from the month-to-month sales numbers (chart is above). While the April-to-May sales were down 3%, we normally see a bit of a lull before we head into the busier summer season – see the May 2021 statistic was about the same as May 2022. With interest rates declining somewhat recently, this could provide some additional relief and buoy the market through the busy season.

I’m sure agents out there could tell us much more about what’s going on right now, because we probably won’t know how the summer turns out until September or October otherwise. If you do have some on-the-ground experience about current conditions, feel free to offer your thoughts as a comment to this article.

Thank you for helping us think about IE housing markets as entering a slowdown as opposed to an outright downturn.

Would you happen to have recommendations for reading about commercial real estate markets? I wonder if this slice of the real estate market is looking like it could possibly return to pre-Covid conditions, or if it appears to be altered for the long term.

Cheers, and thanks.