Updates since Tuesday: Jonathan Lansner’s June 1st “Bubble Watch” article highlighted California’s consumer confidence concerns, mainly driven by inflation and the housing market. Although the consumer confidence index was better than it was a year ago, it has declined month-to-month. Also coming in this week, the region’s unemployment rate for April 2022 was reported at 3.8%, lower than Los Angeles’ 4.3% and right around where it was in late-2019. How low can it go into the summer?

On Tuesday I discussed the growing fear that the economy could be headed for a recession. One of the key components of that argument is the real estate market. Calculated Risk, for example, has noted softening conditions (here as a summary of conditions and here on mortgage applications), and many other analysts are predicting a slowdown.

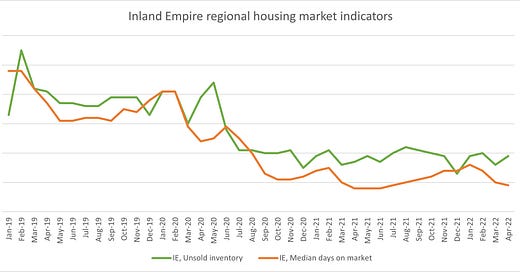

The housing market has recently gone through turbulent times, so some slowdown is to be expected. Higher mortgage rates caused by Fed monetary tightening will undoubtedly reduce demand by increasing implied monthly payments on new home purchases. But regionally, house prices remain high and inventory is also low. Another one of my favorite metrics, median days that a house was on the market before being sold, continues to move laterally as well.

Another sign that the news is mixed comes from building permits, which are an indicator of upcoming supply. The US Census Bureau reports that as of April of this year, permits for 5,946 structures have been authorized for the Inland Empire (4,824 of which are 1-unit structures). This is up from 4,619 structures (3,959 1-units) at this same time a year ago, and 4,162 structures (2,894 of which are 1-unit) in April 2019. Notice also the higher proportion of multi-family structures that these statistics imply. High supply means some damper on prices, but it also means more housing!

In short, this hardly looks like a bubble, and I’m even skeptical about concerns of a slowdown. Affordability is at an all-time low, but the labor market remains strong, suggesting that the market can handle the higher interest rates, at least for now.