Boom and Bust Communities in the IE

The IE markets the suffered - and gained - through the pandemic and remote work

It's not news to anyone that the percentage of people working remotely - either in hybrid or fully remote arrangements - increased dramatically in 2020 and 2021. What might be news to you is that after continuing to grow in 2022 and 2023, remote work rates may have peaked in 2024. It seems that every week we’re learning of a new company/institution removing any remote work from their staff arrangements (even if it was just one day a week). See the chart below, which plots remote work rates from October 2022 to April 2025 for prime-age (25-54) workers, via the Current Population Survey (my own estimates). Decreases in this rate are normal between January and April, but the “levelling off” we saw in the second half of 2024, into 2025, might mean we will be on the other side of this “curve” soon.

The rise of remote work had many implications for workers, both good and bad. What I want to talk about today is its effect on communities. Some areas were targeted by waves of remote workers for their lower housing costs. Others communities were targeted by people fleeing urban areas in the wake of the pandemic. Higher-income people bought second or third homes in these areas as “escapes”, and others uprooted entirely for a more rural life.

Higher-Priced Remote Desert/Mountain Markets That Have Declined

Unfortunately, as both remote work and pandemic-related restrictions and health risks have receded, so has the demand for homes in these areas. Their housing markets, once red-hot, are now cool. In this post, I attempted to identify those "boom" or "bust" towns in San Bernardino and Riverside Counties. I used data from Realtor.com on median listing price of homes by zip code.

Above is a table with the top zip codes I could identify. Palm Springs is one of the starkest examples of the pandemic- and remote work-related boom. Median listing price hovered around 500,000 before the pandemic, and quickly reached above 1 million within 2 years. Since then, listing price has trickled down and sits below 800,000 as of June 2025. See the graph below.

The desert communities are in Riverside County, but San Bernardino County also had a few communities with a peak around 2021/2022. Big Bear (specifically zip 92314, 92315) saw a $300,000 increase in median listing price around the pandemic, peaking at about $750,000 in early 2022. Median listing prices have declined since then, not helped by the Line Fire last August, and are now under $650,000. The trends in these markets continue downward.

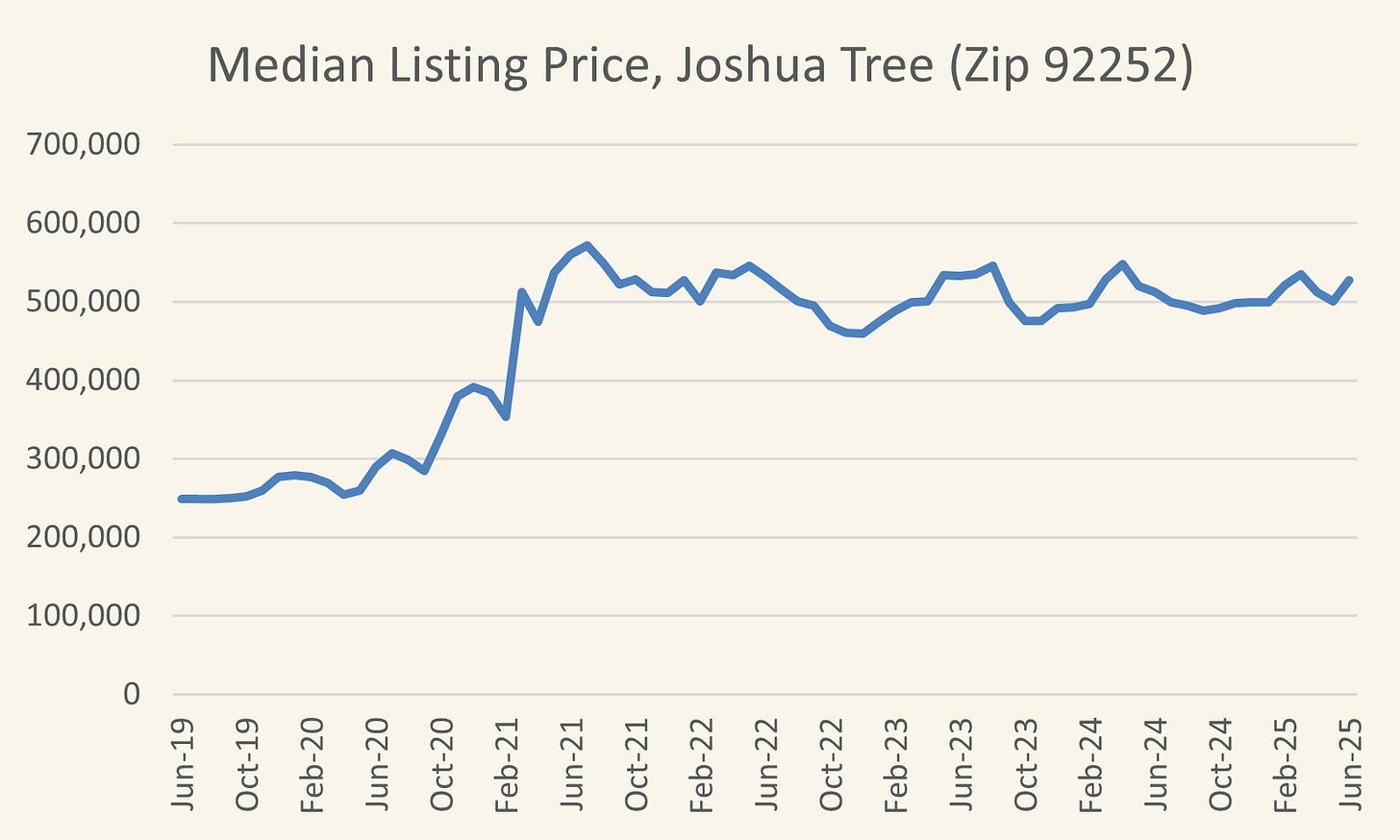

Boom towns that haven’t crashed: Mojave Desert/Joshua Tree

Some towns boomed during the pandemic and haven’t shown any sign of slowing down! Here is a list of some of these communities, as well as two graphs:

Yucca/Landers (92284, 92285); median listing price increased from 240K/146K to 490K/335K between June 2019 and June 2025 – these communities are in the Mojave Desert near Joshua Tree, east of the San Bernardino mountains. Joshua Tree itself (92252) has also grown tremendously, with its median listing price increasing from 249K to 527K. See that zip code below.

It would be interesting to explore more carefully how the spikes in interest in these housing markets have transformed them for good - and how the “boom towns” around Joshua Tree are capitalizing on the increased interest in their markets.